Ira calculator 2021

A Roth IRA is a retirement account that lets your. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more.

. Automated Investing With Tax-Smart Withdrawals. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Single filers have to make less than 129000 in 2022 up from 125000 in 2021 to make a full contribution to a Roth IRA. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. 0 Your life expectancy factor is taken from the IRS.

If you want to simply take your. You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Calculate the required minimum distribution from an inherited IRA.

If inherited assets have been transferred. Save for Retirement by Accessing Fidelitys Range of Investment Options. Use our IRA calculator to see how much your nest egg will grow by the time you reach retirement.

It is important to. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. While long term savings in a Roth IRA may produce.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

Get the Most Out of Your Retirement with a Tdecu Retirement Plan Calculator. Calculate your earnings and more. Converting to a Roth IRA may ultimately help you save money on income taxes.

Individuals will have to pay income. Ready To Turn Your Savings Into Income. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take.

Ad How Much Will You Need To Save For A Comfortable Retirement. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions. Consider a defined benefit plan as an alternative to a SEP IRA if you would like to contribute more than the 2022 SEP IRA limit of 61000.

Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. Account balance as of December 31 2021 7000000 Life expectancy factor. Contributions to a defined benefit plan are dependent.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Your retirement is on the horizon but how far away. This calculator assumes that you make your contribution at the beginning of each year.

For instance if you expect your income level to be lower in a particular year but increase again in later years. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Roll Over Into a TIAA IRA Get a Clearer View Of Your Financial Picture. Traditional IRA Tax Deduction Income Limits in 2021 and 2022. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

Required Minimum Distribution Calculator. How is my RMD calculated. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

The threshold is anything. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow.

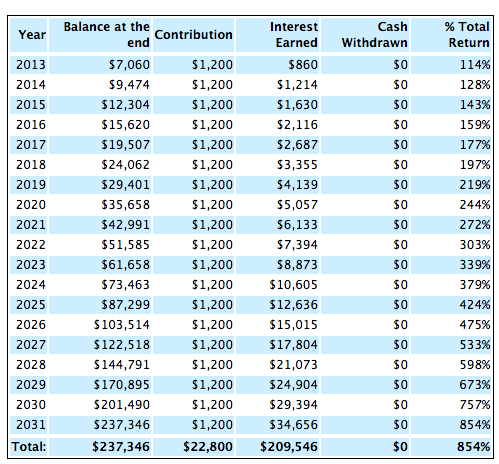

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

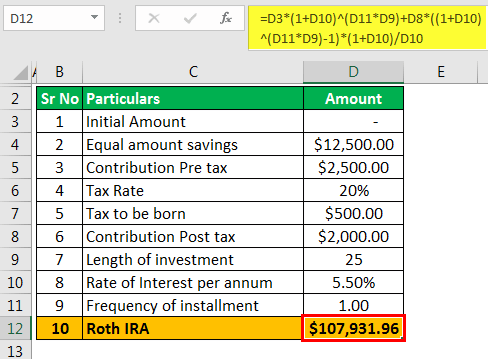

Roth Ira Calculator Calculate Tax Free Amount At Retirement

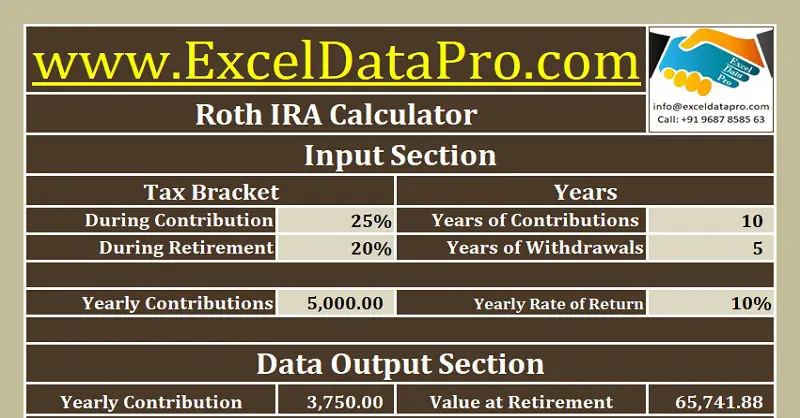

Download Roth Ira Calculator Excel Template Exceldatapro

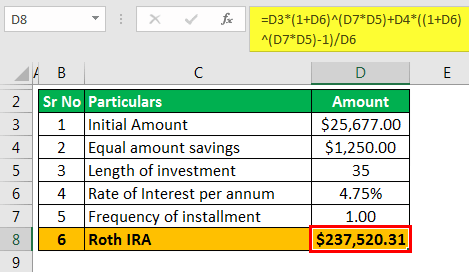

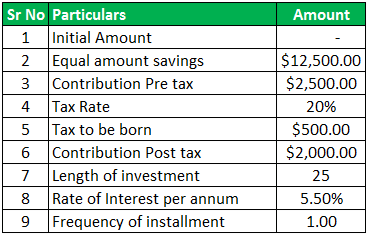

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Retirement Calculator Forbes Advisor

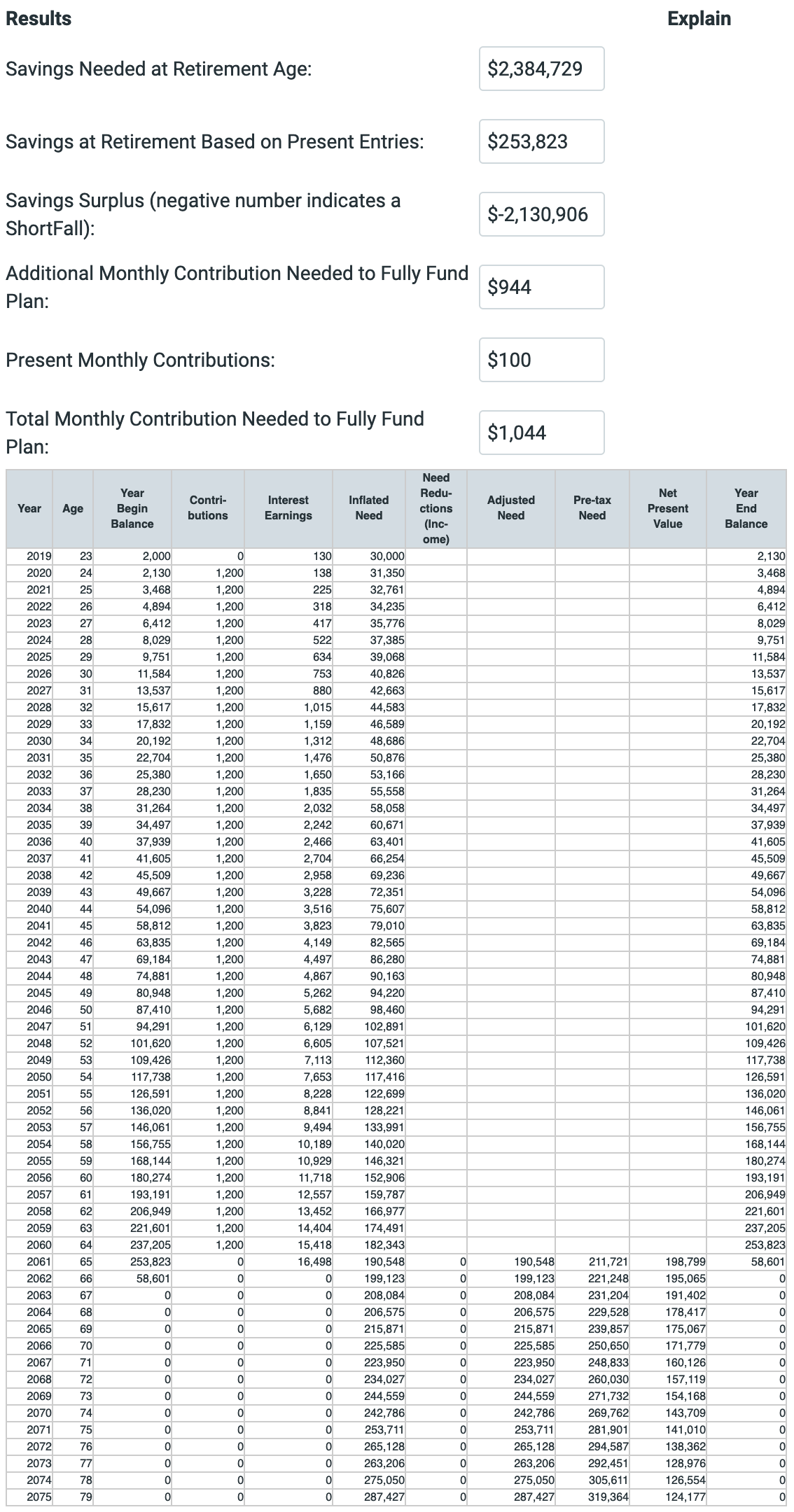

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

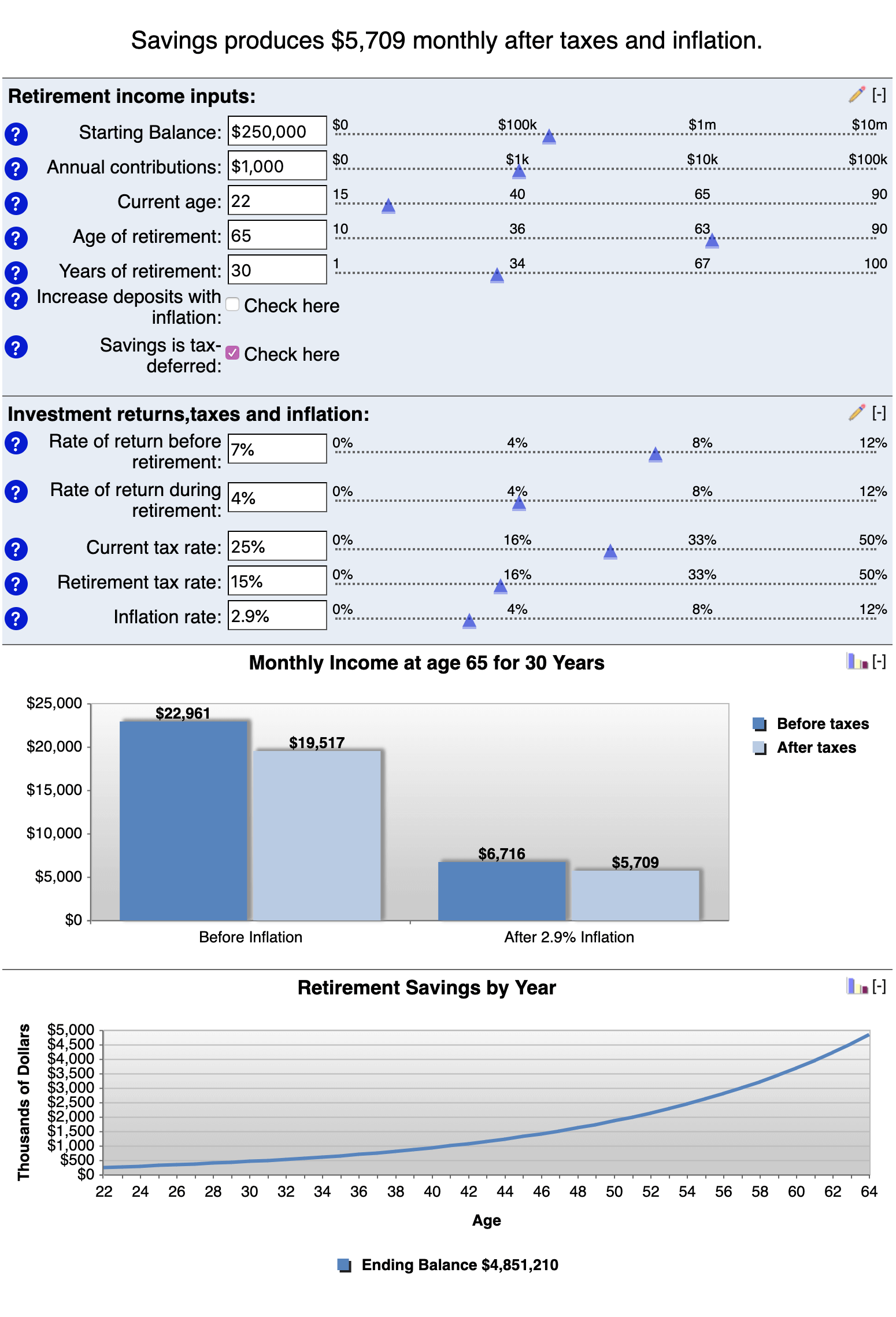

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

The 10 Best Retirement Calculators Newretirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Ira Calculator See What You Ll Have Saved Dqydj

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The 10 Best Retirement Calculators Newretirement